Updated again January 14th.

Also see St. Louis Hires Murder Suspect’s Company for Demo Contract and St. Louis Electeds Repped in Decision to Contract with Accused Murderer

Thursday afternoon, January 8th, a new meeting notice appeared on the City of St. Louis Public Meetings Calendar. It caught the attention of more than a few people.

The notice was for a meeting a week later. 10:30 am Thursday, January 15th, there was to be a “Special” meeting (meaning not a regular weekly or monthly meeting), Zoom only, of the Land Clearance for Redevelopment Authority (LCRA) Board.

The meeting was changed to 12:30 pm Thursday, January 15th, at 12:19 pm Wednesday, January 14th.

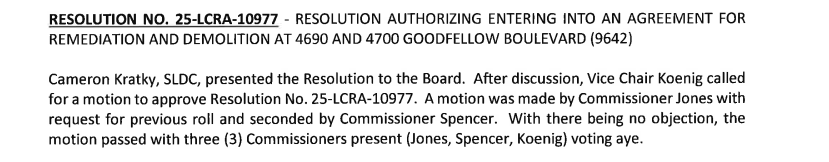

The LCRA Board was the second City entity to approve a $3,692,000 contract with S. Shafer Excavating Inc for environmental remediation and demolition services at 4690 and 4700 Goodfellow Blvd, a 16.45-acre former ammunition plant site.

LCRA spent less than ten minutes on the contract at their December 16th meeting. The Illinois company is owned and run by Sammy J. Shafer Jr., whose murder-for-hire trial is set for April in Madison County. It’s alleged that Shafer Jr. was the mastermind and paid for the murder of Portia Rowland, who had planned to marry his wife, Sarah, after their divorce.

The contract killing never came up in the LCRA meeting.

We don’t know if the murder case came up at the meeting of the first City entity to approve, recommend, the contract with S. Shafer Excavating. There are no Minutes or video available online for the December 9th meeting of the City’s Substantial Awards Selection Committee.

It was there that the contract for services on the Goodfellow site was discussed, mostly in closed session, and Shafer’s company recommended. Members of the Substantial Awards Selection Committee include representatives of Mayor Cara Spencer, Comptroller Donna Baringer, and Board of Alders President Megan Green.

The Meeting Notice for Thursday’s meeting had no agenda posted as of 10:30 am Wednesday, January 14th.

Had the meeting time not been changed and Agenda added, the meeting would have been in violation of Executive Order 60 requiring Notice with Agenda be posted at least 24 hours advance.

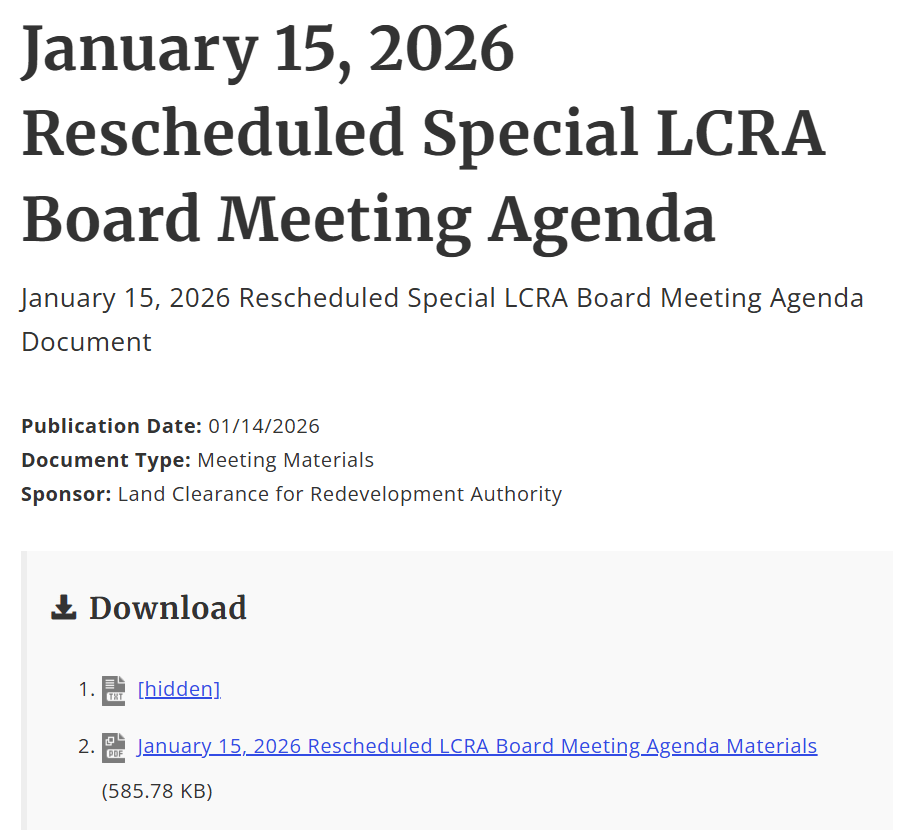

Thursday’s LCRA Meeting Materials page has two files: one is labeled “hidden” and has a link back to the Meetings Materials page; the other is the Agenda and Minutes from last meeting.

The Minutes include information on the vote at last meeting to award the contract to S. Shaffer Excavating.

The S. Shafer Excavating contract is not on Thursday’s Agenda. However, the combination of a “hidden” file on the Meeting Materials page and the listed statutory citations for Closed, Executive Session suggests the contract might come up.

“A) Proceedings involving legal actions, causes of actions or litigation or confidential

or privileged communications with attorneys or auditors as provided by Section

610.021 (1) RSMo. and/or Section 610.021 (18) RSMo.”

“C) Proceedings to regarding sealed bids and proposals and related documents or

documents related to a negotiated contract as provided by Section 610.021 (12)

RSMo.”

But what about accountability? Who is to blame for no background check on Shafer Excavating? Is it an isolated instance at St. Louis Development Corporation, LCRA’s boss, or is this a systemwide failure on contracts?

What was the role of the Substantial Awards Selection Committee, which includes the offices of the three most powerful positions in City government, in this mess? None of them have come forward to say it was a mistake and they’ll do better. I suppose it does take time to find a scapegoat.

And where are St. Louis City Alders on this?

Silence is complicity.

How is the lack of a background check on potential contractors being fixed? Will there be a committee appointed to study the situation and issue a report absolving elected and mayoral appointed officials and identifying a scapegoat? It would not be the first.