When I worked at St. Louis City Hall in the Recorder of Deeds office, our employee manual prohibited use of personal email accounts on our City computers and use of our City email accounts for personal purposes. Both were fireable offenses because of security concerns and highly problematic for Sunshine Law purposes. It is hard for me to imagine that isn’t the case in all government offices. But here we are.

Wednesdays by 5 pm, when the St. Louis City Board of Alders meets on Friday, a Calendar Letter goes out from Board staff to an email list of currently 141 addresses. The Calendar Letter includes the Tentative Agenda for Friday’s Full Board meeting and committee meeting schedule.

The Calendar Letter is mandated by Board of Alders Rule 11. “Sunshine Gerry” Connolly and I have worked for years, since Lewis Reed was Board President, to get the Board to comply with their own Rules as well as improve upon them.

The Board has made some progress on transparency this year under Board President Megan Green but they still do not prohibit use of personal email accounts by Alders for public business. I count Board President as an Alder because the position sponsors and votes on legislation. Board President Green, unfortunately, is one of the electeds still using a personal email account for public business.

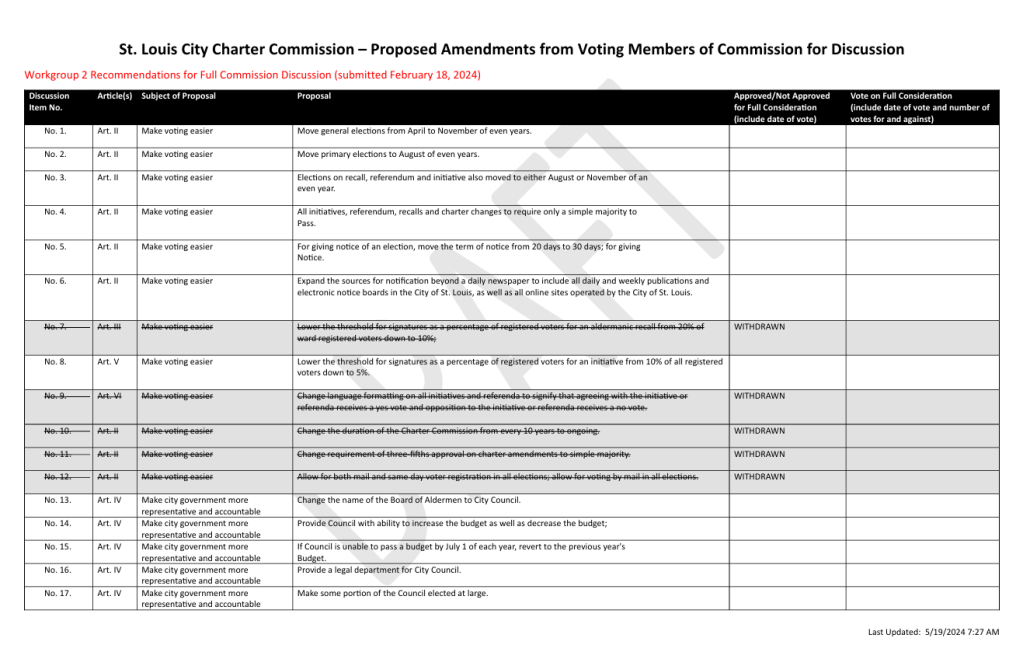

9 of 15 voting members of the Board of Alders on the Calendar Letter email list use only their official City accounts with an @stlouis-mo.gov address.

Three Alders use both their City accounts and personal accounts. If you’re going to Sunshine records from them, make sure to include their personal email: Alder Michael Browning uses michael.james.browning@gmail.com, Alder Joseph Vollmer uses vollmerjoe@att.net, Alder Daniela Velazquez uses dv@danielavelazquez.com.

Board President Green and two Alders only use personal email accounts. Again, if you’re Sunshining records, make sure to include these accounts: Board President Green megan.ellyia@gmail.com, Alder Pam Boyd boydstuff@aol.com, Alder Tom Oldenburg thomas.oldenburg676@gmail.com.

Use of personal email accounts for public business is highly problematic in the same way use of personal social media accounts for public business is a bad idea. “Using a personal account does not nullify state records law. If public records are generated they must be maintained per their retention times, are subject to Missouri’s Sunshine Law, and are considered discoverable information in case of litigation.”

Two former Alders have City email accounts by virtue of their post-Alder employment with the City. “Marlene (Alderwoman) Davis,” as she is still identified on the list, is Legislative Assistant to Alder Laura Keys, who she endorsed for the seat. Former Alder Craig Schmidt works at the City Health Department.

Eight former Alders still have City email accounts but are not on City payroll. Why do Jack Coatar, Steve Conway, Dionne Flowers, Carol Howard, Heather Navarro, Joe Roddy, Jesse Todd, and Joe Vaccaro still have City email accounts?

27 Board of Alders staff, Alders and Board President Office combined, are on the Calendar list using City accounts. So are four former staffers. Mary Ries, Mary Cullins, and Tom Shepard worked for former Board President Reed. Saida Cornejo-Zuniga was Legislative Assistant to Alder Velázquez for less than a year and now works for WePower, a public school privatization advocate. Why do they still have City email accounts?

Five staff for the Mayor and two for Comptroller are on the Calendar list. So is former Deputy Comptroller James Garavaglia. Why?

The City Treasurer and Circuit Attorney each have someone on the list. No one from the other county offices- Collector of Revenue, License Collector, Recorder of Deeds, or Sheriff- participates, best I can tell. I guess they really don’t care about the legislative body of City since they are unfortunately still not organized under City Charter.

16 current Mayor’s Cabinet and Department related City accounts get the Calendar letter using City email accounts. Former employees, including the late Todd Waeltermann (former Streets & Trash Commissioner), former Personnel Director Richard Frank, former Traffic Commissioner Jamie Wilson are still on the list with City email accounts. Why?

When I retired from the City, I had no idea that I could keep my official City email account. It’s apparently forever. Or so I guess since Leonard Johnson, previously with St. Louis Development Corporation, was found guilty of embezzlement in East St. Louis but is still on the list with a City account. At least Kevin Huntspon uses a personal account to receive the Calendar Letter. He pled guilty to bribery during his job as a City health inspector in 2016.

Back to the use of personal email accounts for public business. If you’re going to Sunshine records relating to the Community Mobility Committtee (all on its own a Transparency Fail), make sure to add Scott Ogilvie at gsogilvie@yahoo.com to your request. The Calendar Letter list shows Ogivilie, Program Manager for the City’s Complete Streets program, uses both a City email account and a personal account.

The Calendar Letter is inside baseball. Anyone can ask to be added to the email list via Board Clerk Terry Kennedy (boaclerk@stlouis-mo.gov) but the Board doesn’t promote it. Subsequently, of the 141 email addresses on the list, the largest group of participants after Alders and staff is lobbyists and corporate welfare attorneys. There are only four active media persons on the list.